SOL Price Prediction: 2025-2040 Outlook and Key Levels

#SOL

- Technical Outlook: SOL tests critical support at $162 with mixed technical signals

- Ecosystem Growth: Institutional interest surges 252% despite recent volatility

- Fraud Risks: 98% of Pump.Fun tokens reportedly fraudulent, requiring investor caution

SOL Price Prediction

SOL Technical Analysis: Key Levels to Watch

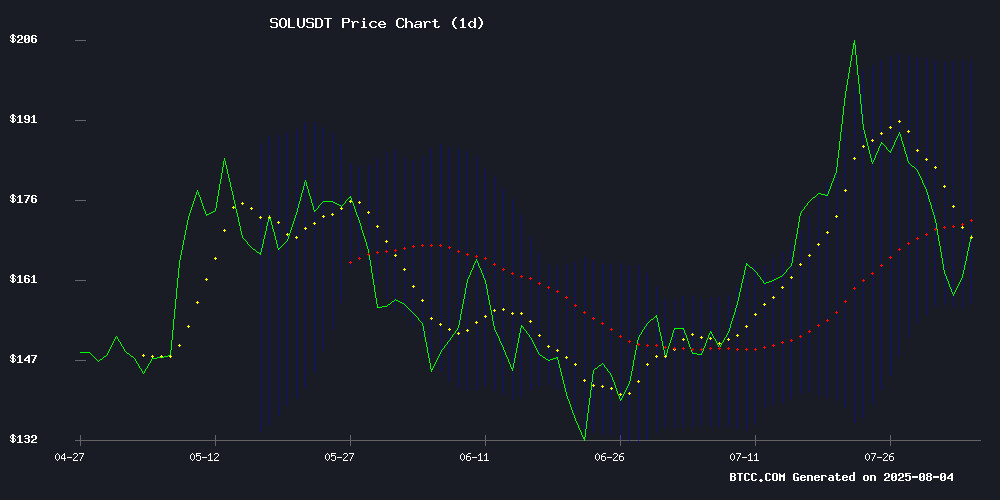

SOL is currently trading at $163.63, below its 20-day moving average of $179.03, indicating short-term bearish pressure. The MACD shows a bullish crossover (1.88 vs -7.89), suggesting potential upward momentum. Bollinger Bands reveal price testing the lower band at $156.06, which may act as support. 'The $160-162 zone is critical,' says BTCC analyst Sophia. 'A hold above could signal consolidation before a retest of the middle band at $179.'

Solana Market Sentiment: Mixed Signals Amid Volatility

News highlights show conflicting forces: institutional interest grows with 252% CME futures surge, while Binance's strategic transfer triggered a 15% drop. 'The $162 support test is pivotal,' notes BTCC's Sophia. 'Positive developments like Superstate's tokenized equities platform contrast with reports of 98% fraudulent tokens on Pump.Fun.' Market sentiment appears cautiously optimistic but highly sensitive to price action around $170.

Factors Influencing SOL's Price

Solana Tests Key Support at $162 as Post-Rally Consolidation Continues

Solana (SOL) hovers near crucial support at $162.00, marking a 0.95% gain amid fading momentum from July's 40% surge. The RSI at 42.43 suggests neutral conditions, with potential oversold signals emerging as the token tests its $161-162 support zone.

Ecosystem developments contrast with short-term technical weakness. Visa and Shopify integrations for Solana Pay highlight institutional adoption, while the Breakout Hackathon attracted over 10,000 participants—evidence of sustained developer activity. Declining active addresses and DeFi TVL, however, reflect natural cooling after last month's rally.

Market structure implies a healthy correction rather than bearish reversal. SOL maintains its position among the top five cryptocurrencies by market cap, with the current consolidation setting the stage for potential accumulation at support levels.

DeFi Development Corp. Partners with Solflare to Boost Solana Ecosystem

DeFi Development Corp., a prominent Solana treasury firm, has entered into a Letter of Intent with Solrise, the developer behind the Solflare wallet. The partnership, effective from 1 August, designates Solflare as the official wallet provider for DeFi Dev, granting its 4 million users access to DeFi Dev's suite of on-chain products.

The collaboration aims to enhance visibility, credibility, and liquidity within the Solana ecosystem. Emerging projects like Snorter Token, a meme coin trading bot that has raised $2.3 million in its presale, stand to benefit from the increased traction.

DeFi Dev will integrate its liquid staking tools and equity offerings into Solflare, while Solflare becomes the default wallet for DeFi Dev's marketing campaigns. In return, DeFi Dev will adopt Solflare's crypto-backed debit card for corporate use.

"This partnership marks a pivotal step toward deepening our involvement in the rapidly evolving Solana ecosystem," said Parker White, COO of DeFi Dev. The move underscores Solana's growing influence in decentralized finance.

Solana Price Prediction: Bounce or Breakdown? All Eyes on the $170 Reclaim Level

Solana stands at a critical juncture as institutional demand collides with technical support levels. The cryptocurrency, currently trading at $158.07 after a 3.38% dip, faces a decisive moment near the $150-$160 zone—a historical springboard for rallies.

CME futures open interest has surged 370% to $800 million in August, eclipsing exchanges like MEXC and KuCoin. This explosion coincides with the first U.S.-approved Solana staking ETF, signaling institutional conviction beyond speculative trading. Market participants now watch whether ETF-driven flows can propel SOL past resistance.

Solana (SOL) Futures Surge 252% on CME as Institutional Interest Grows

Solana futures volume on the Chicago Mercantile Exchange (CME) skyrocketed 252% in July, reaching $8.1 billion. This surge highlights escalating institutional interest in SOL as the cryptocurrency market enters a new bullish phase.

The asset closed the week at $161, posting a 9% monthly gain. Technical indicators suggest a bullish structure, though SOL faces stiff resistance near the $195 level. A long upper wick on the weekly candle indicates profit-taking or rejection at the upper Bollinger Band.

CME's derivatives data signals growing confidence in Solana's long-term potential among traditional finance players. The Layer-1 blockchain is increasingly viewed as a maturing asset class rather than just a crypto project. Market participants now watch whether this derivatives activity will translate into sustained spot price momentum.

Solana Plummets 15% Amid Binance's Strategic SOL Transfer

Solana (SOL) faced a steep 15% decline this week, erasing nearly a month of gains as Binance offloaded 110,000 SOL to Wintermute. The move, interpreted as tactical selling, coincided with stagnant prices at $180 and excessive retail leverage betting on a breakout to $200.

Liquidations hit $46 million on August 1—the highest since Q1—as SOL tests critical support at $160. Market sentiment soured rapidly, with the token's underperformance highlighting broader deleveraging pressures across crypto markets.

Solana Price Drop Raises Questions About Market Direction

Solana's price has plummeted more than 20% in the past week, sliding from a recent high of $205 to around $165. The sharp decline has ignited debate among traders and analysts—is this a temporary correction or a sign of deeper structural shifts in Solana's market position?

The downturn coincides with a strategic pivot in Solana's ecosystem. Where memecoins and speculative trading once dominated volume, co-founder Anatoly Yakovenko is now steering development toward infrastructure projects like the Internet Capital Market. Institutional adoption may strengthen Solana long-term, but the transition appears to be cooling the retail frenzy that previously fueled price surges.

Network metrics tell a different story. Daily active addresses maintain robustness, fluctuating between 3-6 million throughout 2025 with occasional spikes above 7 million. This sustained activity suggests underlying utility persists despite bearish technical signals in the market.

Solana Holds Steady at $169 as XYZVerse Emerges as Potential Breakout Candidate

Solana maintains its position near $169, buoyed by growing institutional interest. The token's 21% monthly gain has shifted attention to emerging projects like XYZVerse, now in its 13th presale phase at $0.005 with ambitions for a $0.10 launch price.

XYZVerse's momentum stems from favorable market conditions and robust tokenomics, having raised $15 million. The memecoin sector shows renewed vigor as investors diversify into lower-cap assets, creating fertile ground for speculative plays.

Market observers draw parallels between Solana's recent performance and XYZVerse's potential trajectory. Both projects now serve as bellwethers for altcoin market sentiment, with their next moves likely influencing broader crypto investment strategies.

Traders Profited $100M in Suspicious MELANIA Token Pre-Launch Buys

An investigation has uncovered that a group of traders made nearly $100 million by purchasing MELANIA tokens minutes before its official launch. Financial Times analysts identified millions of dollars worth of pre-launch transactions, with estimated combined profits reaching $99.6 million.

The SOL-based MELANIA memecoin launched on January 19, 2025, following the controversial OFFICIAL TRUMP token release. Both tokens have drawn criticism for their lack of transparency, potential conflicts of interest, and perceived emphasis on cryptocurrency speculation rather than utility.

The timing of MELANIA's launch - just one day before Donald Trump's inauguration - has raised further questions about the token's purpose and the nature of its pre-launch trading activity. These developments highlight ongoing concerns about market manipulation in the memecoin sector.

Superstate Launches Tokenized Equities Platform on Solana

Superstate, the asset management firm behind the $650 million USTB token, is expanding into stock tokenization with its new blockchain-based marketplace, Opening Bell. The platform will debut on Solana (SOL), offering tokenized versions of SEC-registered shares—distinct from derivatives or synthetic assets—enabling direct trading on blockchain infrastructure.

Unlike traditional stock exchanges with multi-day settlements, Opening Bell facilitates real-time, 24/7 trading and programmable securities. The platform caters to both publicly traded companies and late-stage private firms seeking liquidity. Canadian investment firm SOL Strategies has announced plans to be the first issuer on the platform.

Superstate Launches Opening Bell to Bring Public Equity Trading to Solana

Superstate has introduced Opening Bell, a platform enabling SEC-registered public shares to be issued and traded directly on blockchains, starting with Solana. SOL Strategies, a Canadian public company focused on Solana infrastructure, will be the first to list shares through this system.

The initiative represents a pivotal integration of public capital markets with digital assets. Unlike synthetic or wrapped tokens, Superstate's infrastructure allows companies to issue real, authorized equity on-chain. These shares are fully transferable, programmable, and capable of real-time settlement.

"This is a fundamental shift in capital markets," said Robert Leshner, CEO of Superstate. "We're bringing real equities into DeFi."

98% of Tokens on Pump.Fun Identified as Fraudulent, Report Reveals

A damning report by Solidus Labs exposes rampant fraud on Solana-based token launch platform Pump.fun. Nearly 99% of the 7 million tokens created since January 2024 qualify as rug pulls or pump-and-dump schemes. Only 97,000 tokens maintained minimal liquidity of $1,000.

The platform's low-cost token creation mechanism has become a haven for bad actors, with the largest identified scam involving MToken netting $1.9 million. This revelation comes as the crypto industry continues grappling with security challenges despite post-FTX reforms.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and ecosystem developments, BTCC's Sophia provides this projection framework:

| Year | Bull Case | Base Case | Bear Case |

|---|---|---|---|

| 2025 | $250 | $180 | $120 |

| 2030 | $800 | $450 | $200 |

| 2035 | $2,500 | $1,200 | $600 |

| 2040 | $5,000+ | $3,000 | $1,000 |

Key assumptions include: institutional adoption continuing at current rates, Solana maintaining >20% of DeFi market share, and no existential smart contract risks materializing. 'These projections must adjust quarterly,' Sophia emphasizes.